Current bond price formula

Calculating Yield to Maturity on a Zero-coupon Bond YTM MP 1n - 1. Bond YTM Calculator Outputs.

Bond Yield Formula Calculator Example With Excel Template

Bond price when yield increases by 1 Price-1.

. Current Bond Trading Price - The price the bond trades at today. The term bond formula refers to the bond price determination technique that involves computation of present value PV of all probable future cash flows such as coupon payments and par or face value at maturity. Premium bond Premium Bond A premium bond refers to a financial instrument that trades in the secondary market at a price exceeding its face value.

The converged upon solution for the yield to maturity of the. This occurs when a bonds coupon rate surpasses its prevailing market rate of interest. The calculation for Coupon Rate of 4.

Bond price when yield decreases by 1 Price. The PV is calculated by discounting the cash flow using yield to maturity YTM. You calculate current yield by dividing the annual interest earnings by the current market price of the bond 5 110 in this case.

The yield to maturity YTM. Current trading price Δyield. Annual coupon payment Current market price 100 950 1053 Scenario 2.

Years to Maturity - The numbers of years until bond maturity. Bond Face ValuePar Value - The face value of the bond also known as the par value of the bond. Here is an example calculation for the purchase price of a 1000000 face value bond with a 10 year duration and a 6 annual interest rate.

Because this formula is based on the purchase price rather than the par value of. Yields are highly dependent on interest rates. Percentage point change in yield note that its squared.

Coupon payment 4 100000 4000. Sign doesnt matter But stick with the better convexity formula if you have time to calculate it or come back and visit this page. The denominator or the price of the bond Price Of The Bond The bond pricing formula calculates the present value of the probable future cash flows which include coupon payments and the par value which is the redemption amount at maturity.

The current yield of a bond is calculated by dividing the annual coupon payment by the bonds current market value. Duration 63 years. Yield to Maturity Calculator Inputs.

Mathematically the formula for coupon bond is represented as. Yield to Maturity.

Bond Yield Calculator

Excel Formula Bond Valuation Example Exceljet

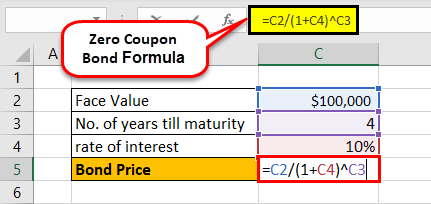

Zero Coupon Bond Formula And Calculator Excel Template

How To Calculate Pv Of A Different Bond Type With Excel

Learn How To Calculate Bond Price Value Tutorial Definition Formula And Example

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Bond Pricing Formula How To Calculate Bond Price Examples

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Chapter 10 Bond Prices And Yields 4 19 Ppt Download

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Pricing Formula How To Calculate Bond Price Examples

How To Calculate The Current Price Of A Bond Youtube

Bond Pricing Formula How To Calculate Bond Price Examples

Yield To Call Ytc Bond Formula And Calculator Excel Template

An Introduction To Bonds Bond Valuation Bond Pricing

How To Calculate Bond Price In Excel

Bond Pricing Formula How To Calculate Bond Price Examples