Diminishing value rate calculator

For the second year the depreciation charge will be made on the diminished value ie. The diminishing value method allows for a higher depreciation deduction of the asset in the first years of ownership and then reduces over its effective life using the following.

How To Calculate The Diminished Value Of Your Car Yourmechanic Advice

Expected rate of depreciation is considered as 15 annually here.

. Cost value 10000 DV rate 30 3000. 6 4000059999 miles. A company has brought a car that values INR 500000 and the useful life of the car as expected by the buyers is ten years.

Once your auto insurance. Year 1 2000 x 20 400 Year 2 2000 400 1600 x. Ad Insurance Total Loss Dispute Settlement - Diminished Value Claims.

2000 - 500 x 30 percent 450. 4 6000079999 miles. Thus the value of the equipment is diminished by Rs 10000 and becomes Rs 90000.

Step one - Calculate the depreciation charge by using below given formula Depreciation charge per year Asset value -. 8 2000039999 miles. And the residual value is.

As a result multiply the value you obtained using the NADA or Kelley Blue Book calculator by10. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense. Diminishing Balance Method Example 1.

Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. Select Your Currency Vehicle Mileage 0 20000 40000 60000 80000. This online calculator is used to find the diminished value with vehicle mileage retail price and the damage modifier.

Depreciation of most cars based on ATO estimates of useful life is. Pre-purchase Inspection - Free Consultation -Available Weekends - Call Now. Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income.

Inherent diminished value occurs when a vehicle loses value because it now has a history of damage which is indicated in the cars history reports. This determines the maximum amount your cars insurance carrier will pay. 0 019999 miles.

2 8000099999 miles. Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows. If you paid 10000 for a commercial espresso machine with a diminishing value rate of 30 work out the first years depreciation like this.

This type of diminished value.

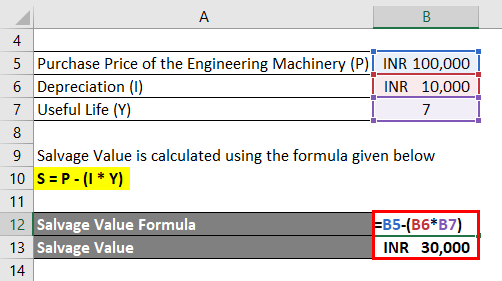

Salvage Value Formula Calculator Excel Template

Depreciation Formula Calculate Depreciation Expense

Salvage Value Formula Calculator Excel Template

Salvage Value Formula Calculator Excel Template

Depreciation Calculation

Depreciation Formula Calculate Depreciation Expense

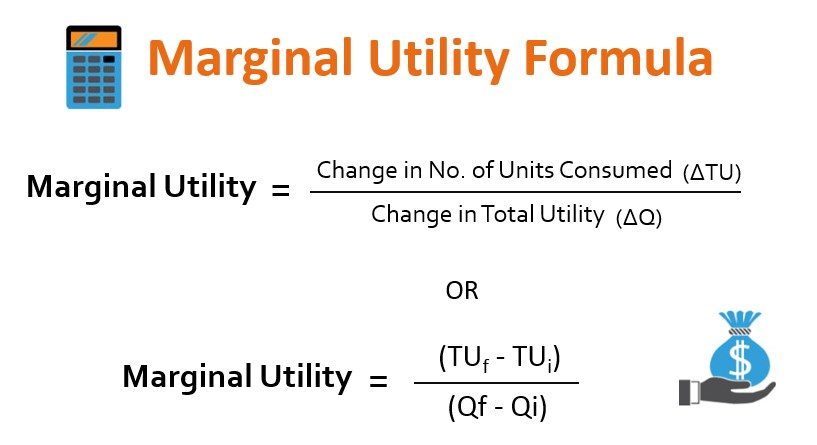

Marginal Utility Formula Calculator Example With Excel Template

How To Calculate The Diminished Value Of Your Car Yourmechanic Advice

Prime Cost Straight Line And Diminishing Value Methods Australian Taxation Office

How To Calculate The Diminished Value Of Your Car Yourmechanic Advice

Double Declining Balance Depreciation Calculator

Solved I M Trying To Calculate For The Diminishing Rate On Chegg Com

How To Use The Excel Db Function Exceljet

Written Down Value Method Of Depreciation Calculation

How To Calculate The Diminished Value Of Your Car Yourmechanic Advice

How To Use The Excel Ddb Function Exceljet

Salvage Value Formula Calculator Excel Template